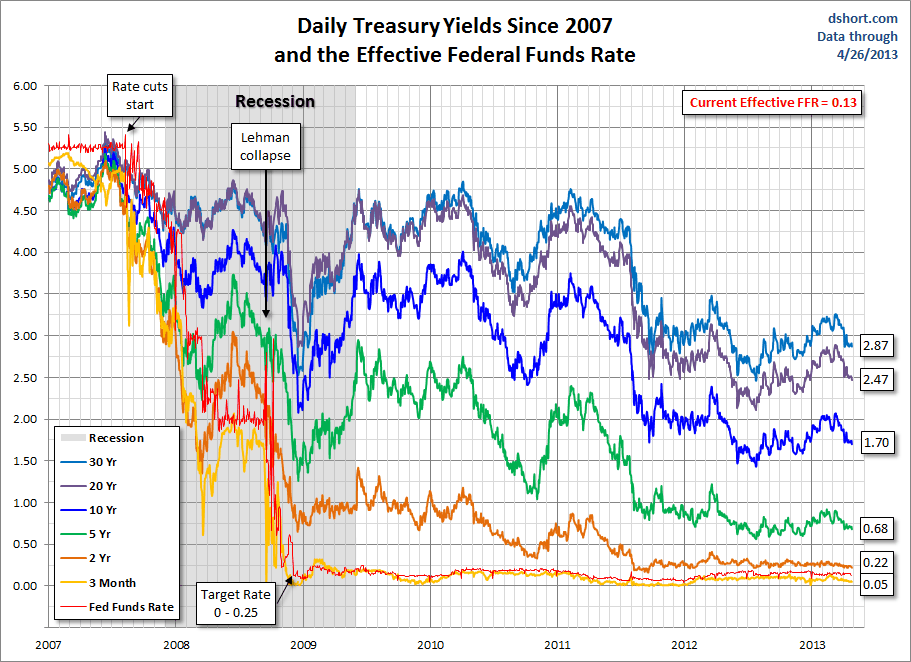

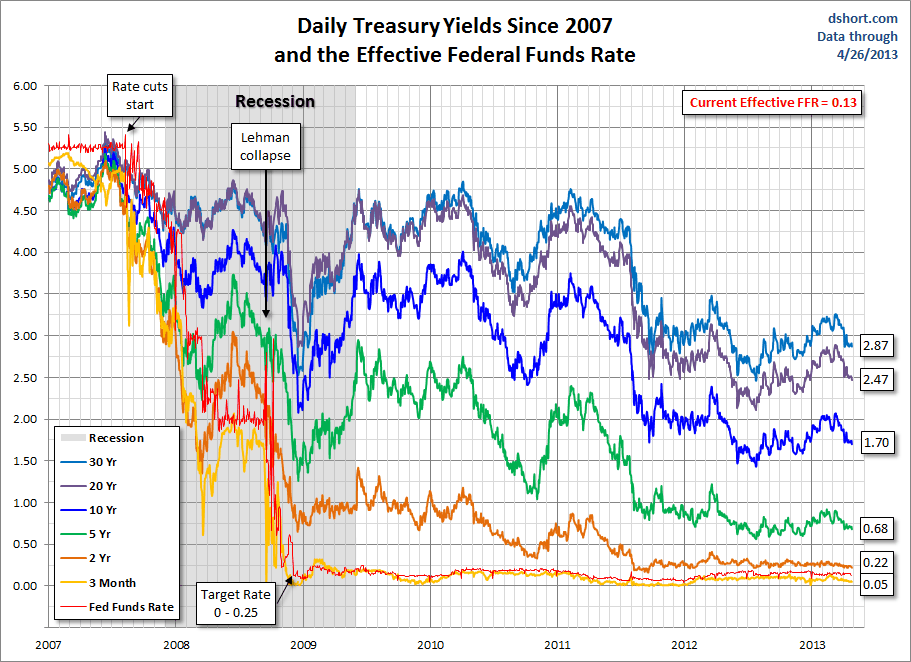

Then, by the late fall of 2008 when the Great Recession was at its worst, bill yields plummeted to a low of 0.01 percent, and remained below 1 percent until the middle of 2017. As the economy recovered and investor confidence in the economy grew between 20, the demand for Treasury securities lessened and thus the yields on bills and notes both rose to around 5 percent. In July 2003, the daily yield on Treasury bills was 1.0 percent and the yield on notes was 4.4 percent because of demand for safe investments in light of the 2001 recession.

The daily interest rates for both 3-month Treasury bills and 10-year Treasury notes experienced notable fluctuations between July 2003 and July 2023. While the rate briefly declined during the COVID-19 pandemic, it has since increased to 2.8 percent as of June 2023. At the end of 2019, before the pandemic hit, the average interest rate had only crept up to 2.4 percent. The average interest rate began to fall at the onset of the 2008 financial crisis and remained low throughout the recovery, reaching 2.2 percent in November 2016.

interest-bearing debt declined from 5.1 percent in January of 2003 to 1.6 percent near the end of 2021. Treasury data show that the average interest rate on all U.S. Today, bills represent 18 percent of marketable debt as pandemic-related borrowing has stopped.Īverage Interest Rate on Treasury Securities For example, bills represented 15 percent of total marketable debt at the end of 2011, but borrowing to address the pandemic boosted that share to 24 percent, reflecting the comparative ease with which the Treasury can raise cash quickly by issuing bills. That share has declined due to the increased issuance of other securities such as bonds and bills in response to the federal government’s borrowing needs. While Treasury notes account for the majority of outstanding securities, the share of marketable debt represented by such securities has declined over the years - from 67 percent in 2011 to 55 percent today. Introduced in 2014, FRNs represented 2 percent of total marketable debt at the end of June 2023.

Floating-Rate Notes (FRNs) have a maturity of two years and a rate of interest that is adjusted each quarter the rate is based on the prevailing interest rate for 13-week Treasury bills. TIPS represented roughly 8 percent of all marketable debt at the end of June 2023. The principal amount on TIPS are adjusted semiannually to account for inflation interest is paid every six months on the adjusted principal. Treasury Inflation-Protected Securities, or TIPS, have maturities of 5, 10, and 30 years. Bonds are also coupon securities and represented about 17 percent of all marketable debt at the end of June 2023. Treasury Bonds maturities of more than 10 years. Notes are the single largest category of Treasury securities, representing about 55 percent of all marketable debt at the close of June 2023. Notes are coupon securities, which means that the semiannual interest payments are set at the time of issuance and purchasers collect the principal at maturity. Treasury Notes have maturities ranging from two to 10 years. Bills represented about 18 percent of all outstanding marketable Treasury debt at the end of June 2023. Such short-term securities are issued at a discount and the face value is paid upon maturity. Treasury Bills have a maturity of one year or less. Marketable Treasury securities are issued in various forms: Nonmarketable securities are issued directly to buyers (rather than auctioned) and are not traded in secondary markets that type of issuance made up just 2 percent of total debt held by the public at the end of June 2023. Such securities represented 98 percent of all debt held by the public as of June 2023. Marketable securities are sold at auction in various maturities and traded on secondary markets. Treasury offers marketable and nonmarketable securities. As the United States continues to borrow a significant amount of money each year, let’s take a closer look at a few key characteristics of Treasury borrowing that can affect its budgetary cost, including the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms. Debt held by the public does not include intragovernmental debt, which, in simple terms, is debt that the government owns itself. That figure represents the net amount that the United States Treasury has borrowed from creditors by issuing securities that raise cash to support government activities. CBO expects total federal borrowing from the public to reach $25.8 trillion in 2023, the highest amount ever recorded.

0 kommentar(er)

0 kommentar(er)